ChatGPT and the evolving role of the Analyst

The great science fiction author Arthur C. Clarke famously said “Any sufficiently advanced technology is indistinguishable from magic”, and indeed it seems like we are in the midst of an Arthur C. moment with Generative AI. ChatGPT (and its many compatriots) have taken the world by storm. However, behind its dazzling array of personas and polymathic knowledge base lies not the arcane, but instead, the decades-long accumulation of research in deep learning that has culminated in the form of a chatbot. As with any and all technological revolutions that have come before it, advancement brings both disruption and opportunity. The opportunity ChatGPT presents is the democratization of AI – the ability to access its powers without prior technical (AI) or programming knowledge. As domain experts this serves as a powerful tool to make us more efficient and effective in what we do.

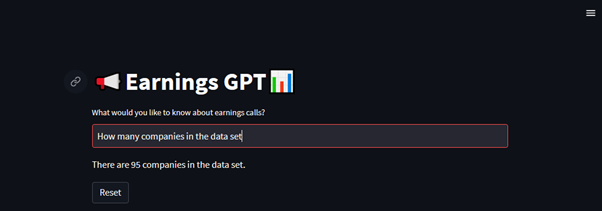

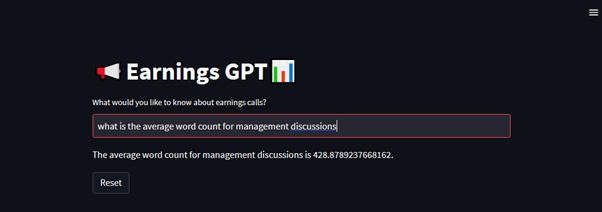

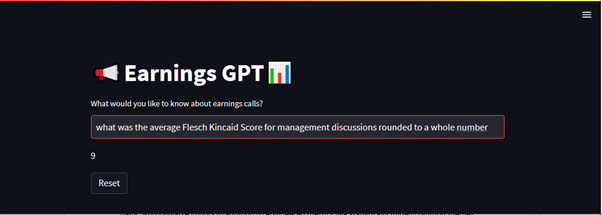

One example is earnings call transcripts. Quarterly earnings calls in the US serve as an important conduit for analysts to access management of listed companies, as well as an information dissemination mechanism for the broader market. What is said on these calls and how it’s said are often the objects of scrutiny for industry and academia alike. At WhyPred, we clean and curate earnings call transcripts using Natural Language Processing (NLP) techniques to turn unstructured text data into structured tables stored in databases. The tables include features such as breakdowns of the call by management discussion and question-and-answer sections tagged by speaker, question-and-answer pairs, and word/syllable counts, in addition to engineered metrics like statistically mined themes and readability scores. Traditionally, to extract insight from data stored this way we’d need to be proficient at SQL and data analysis. However, with the availability of the ChatGPT API we can quickly build our own Large Language Model (LLM) agent to do this for us. As ChatGPT is only trained on data up to 2021, we incorporate another framework called LangChain into the workflow which allows us to build an agent on top of ChatGPT with our own data. Below are some screenshots of “Earnings GPT” in action with a subset of last quarter’s Nasdaq 100 transcripts:

Figure 1. Source: WhyPred

Figure 2. Source: WhyPred

Figure 3. Source: WhyPred

(Flesch-Kincaid Grade Level is the school grade level of education (US) required to understand the text at hand)

This is just one of many use cases for Generative AI within investments. While AI still has a long way to go before it can replace humans, the next generation of analysts will need to know how to use AI in carrying out their roles.

For more insights on earnings calls and Generative AI, feel free to connect @ https://www.linkedin.com/in/michael-wang-9a78011b5/

By: Michael Wang, CFA

Michael is the Head of Data Science at CreditorWatch and Principal Consultant at WhyPred. He has worked across data science consulting, portfolio management, asset allocation, hedge funds as well as teaching at University Sydney.

Views are author’s own and do not reflect financial advice or views of his employers.

Date: 29 May 2023

Read: Powerhouse skills: A look at coding & quant skills for investment management >

CFA Program: Is it right for me?

Take the Readiness Assessment >Achieve one of the highest distinctions in the investment management profession: Become a Chartered Financial Analyst® (CFA®). As a CFA® charterholder, you will have the knowledge and the skills to thrive in the competitive investing industry.